《TAIPEI TIMES》 MOJ proposes tougher measures on fraud

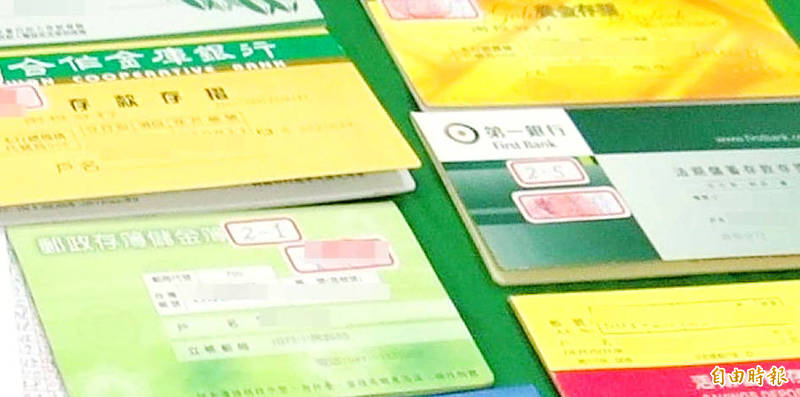

Bank passbooks confiscated by police from suspects in a fraud case are pictured in an undated photograph. Photo: Taipei Times file

FRAUD: The Ministry of Justice’s proposal calls for tougher penalties and a system allowing police to gather transaction information on restricted individuals

By Chung Li-hua and William Hetherington / Staff reporter, with staff writer

The Ministry of Justice (MOJ) has announced an amendment proposal to restrict bank access for five years for people who are found guilty of selling financial accounts or account numbers.

The proposed amendment to the Regulations Governing Accounts Associated With Cases Violating the Money Laundering Control Act (洗錢防制法帳戶、帳號暫停、限制功能或逕予關閉管理辦法) came after amendments to the Money Laundering Control Act (洗錢防制法) passed in May, which introduced a maximum penalty of three years imprisonment, or a fine of up to NT$1 million (US$31,049), for people found guilty of selling financial accounts or account numbers. The earlier amendment was introduced as part of efforts to crack down on financial fraud.

Under the current act, first-time offenders selling one or two accounts would be given a warning, while those selling three or more accounts on the first offense, or violating the law again within five years of a warning, would be subject to fines and imprisonment.

The current act also requires that financial institutions, virtual currency-trading platforms, and third-party payment services close all accounts identified as being associated with such fraudulent activity.

Under the ministry’s proposed amendment to the regulations, people found guilty of a first offense of selling or providing their accounts would have all their accounts in the nation restricted or suspended. Banks would also be required to reject any new account application by these individuals during a five-year restriction period.

The proposal stipulates that those with restricted accounts would not be allowed to deal with more than NT$10,000 a day — including transfers and withdrawals, and transaction fees imposed by the financial institution — for the purpose of paying utilities, fines or other fees.

Only in-person transfer through bank tellers would be permitted, as restricted accounts would be prohibited from accessing online banking (including mobile banking), telephone banking and linking accounts to other payment platforms.

Electronic-payment accounts would be limited to a monthly cumulative maximum of NT$30,000 worth of transactions.

Third-party payment-service providers would be required to limit those under restrictions to only one account, and would not be permitted to provide virtual account services. A minimum of 20 days would be required for funds to be transferred through such a service, and transactions would be capped at NT$20,000, with the monthly cumulative total capped at NT$200,000.

The proposal also calls for the establishment of a system that would permit police to gather transaction information on restricted individuals simultaneously from financial institutions nationwide.

新聞來源:TAIPEI TIMES