《TAIPEI TIMES》Central bank keeps rates same, tightens mortgages

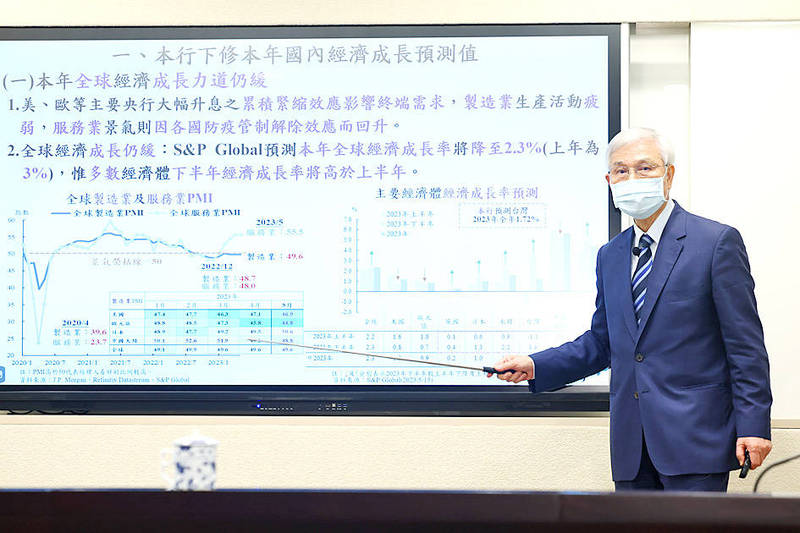

Central bank Governor Yang Chin-long speaks at a news conference at the bank in Taipei yesterday. Photo: CNA

SELECTIVE CONTROLS: The central bank lowered the loan-to-value ratio for second-home mortgages from 75 percent to 70 percent in six cities including Taipei

By Crystal Hsu / Staff reporter

The central bank yesterday kept its policy rates unchanged as it took cues from the US Federal Reserve’s announcement overnight, and tightened lending terms for second-home mortgages in some municipalities.

Taiwan’s central bank cut its GDP growth forecast for this year from 2.21 percent to 1.72 percent and raised its consumer price index (CPI) projection from 2.09 percent to 2.24 percent.

“Fighting inflation remains our top priority, but we think it is time to pause and see how previous rate hikes will affect inflation and the economy,” central bank Governor Yang Chin-long (楊金龍) told a news conference after the bank’s quarterly board meeting.

The discount rate would stay unchanged at 1.875 percent, the collateralized refinancing rate would stay at 2.25 percent and the unsecured lending would remain 4.125 percent, the bank added.

Yang said he cannot rule out resuming interest rate hikes if inflationary readings veer from the bank’s 2 percent target.

Entertainment and rent costs, as well as wage increases, have boosted the CPI and hindered efforts to reduce inflation, Yang said, adding that inflation driven by the service sector would persist until supply and demand reach an equilibrium.

That explains why central banks worldwide are more willing to live with high inflation and wait to achieve their 2 percent targets next year or in 2025, he said.

Economic weakness at home and abroad warrants the tempered approach, he added.

The central bank is more conservative than the Directorate-General of Budget, Accounting and Statistics (DGBAS) about Taiwan’s export and private investment outlook, and less upbeat about private consumption.

The statistics agency last month forecast GDP growth of 2.04 percent for this year.

The Fed said that a rate pause would give it more time to observe the cumulative and lagging effects of earlier interest rate hikes.

Taiwan’s central bank has raised rates by 75 basis points since March last year to curb inflation.

Last month, the CPI rose 2.02 percent from a year earlier, the slowest rise since July 2021, DGBAS data showed.

The central bank yesterday also lowered the loan-to-value (LTV) ratio for second-home mortgages from 75 percent to 70 percent in Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung, as well as Hsinchu City and County.

The move came after house loans climbed to 37 percent of overall lending in April, from 36.83 percent in December last year, while the LTV ratios increased from 75.5 percent to 77 percent, warranting further selective credit controls, Yang said.

Hopefully, the move would help prevent capital from flowing to the real-estate sector, he said.

新聞來源:TAIPEI TIMES