《TAIPEI TIMES》 Central bank policy rates unchanged

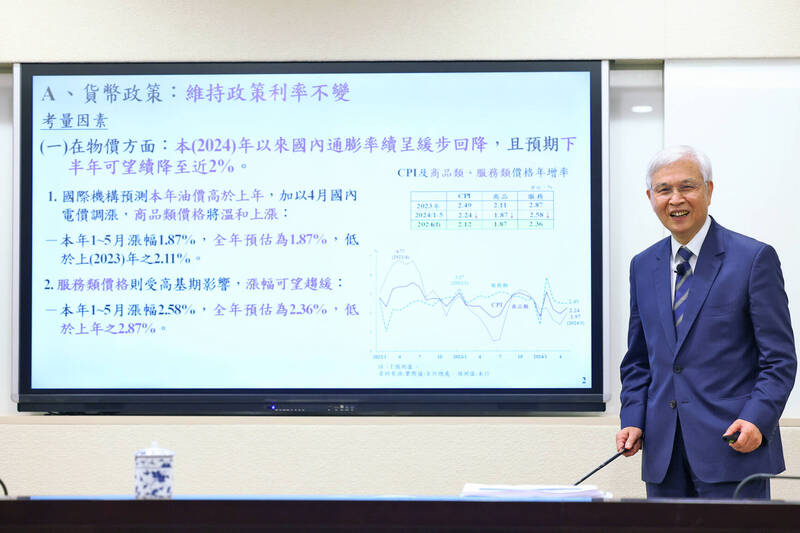

Central bank Governor Yang Chin-long speaks at a news conference at the bank in Taipei yesterday. Photo: CNA

PROPERTY ISSUE: No actions would be taken to curb real-estate price hikes stemming from improving economic fundamentals, as they are not worrying, an official said

By Crystal Hsu / Staff reporter

The central bank yesterday kept its policy rates unchanged, but hiked banks’ required reserve ratio by 25 basis points and tightened second-home mortgage terms, in a measured effort to cool the property market.

“The loan-to-value cap for second-home purchases will be restricted from 70 percent to 60 percent” in the six special municipalities — Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung — plus Hsinchu city and county, effective today, central bank Governor Yang Chin-long (楊金龍) told a news briefing after a quarterly policy meeting.

The latest reserve requirement ratio move would take approximately NT$120 billion (US$3.71 billion) out of the market, starting next month, to help prevent an overconcentration of real-estate loans and ensure financial market stability, Yang said.

The bank’s rediscount rate remained at 2 percent, while the secured lending and unsecured lending rates stood at 2.375 percent and 4.25 percent respectively.

The renewed selective credit controls and reserve requirements followed house loans and home prices advancing rapidly after the government in August last year introduced interest subsidies and other favorable lending terms for first-home purchases.

The Ministry of Finance, which is responsible for the stimulus program with help from state-run banks, is to conduct a review and close loopholes of the program to prevent its abuse, the governor said.

While the central bank pays close attention to house prices, it would not necessarily take action to curb house price hikes, if they stem from improving economic fundamentals, Yang said.

Taiwan has gained importance on the world stage for supplying electronics used in smartphones and artificial intelligence applications, a megatrend that is prompting local firms to build new plants and pushing up house prices near the plants, the governor said.

Yang said he is not particularly worried about house price increases that have the backing of economic fundamentals.

What matters for the central bank is whether house price hikes would threaten the nation’s financial market stability and whether there is an overconcentration of real-estate loans, he added.

Stress tests show local lenders could withstand shocks when interest rates climb to 3 percent and house prices plunge 40 percent, Yang said.

The central bank left interest rates intact, because inflationary pressure has been subdued and a negative output gap lingers, he said.

The central bank raised its forecast for GDP growth this year to 3.77 percent, up from the 3.22 percent it predicted in March.

The central bank is expecting a milder 2.12 percent increase in the consumer price index (CPI) for this year, down from 2.16 percent previously.

Core CPI would ease to 2 percent, lower than the headline CPI, in a rare phenomenon, the governor said.

A long-term cautious financial planning for prospective first-home buyers is necessary, Yang said.

The interest subsidies would last only three years and grace periods five years, he added.

新聞來源:TAIPEI TIMES