《TAIPEI TIMES》 Executive Yuan approves digital payment proposals

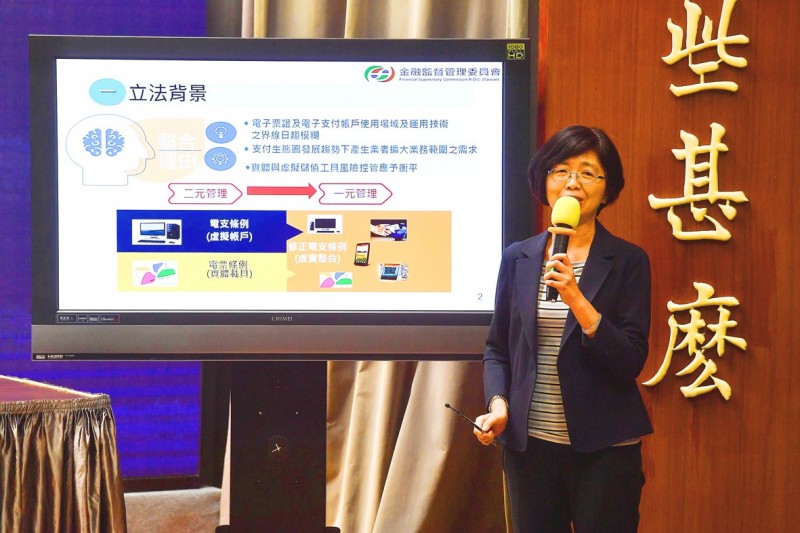

Banking Bureau Director-General Sherri Chuang speaks during a news conference at the Executive Yuan yesterdday. Photo: CNA

EASE OF USE: The proposals include integrating mobile payment devices with electronic payment services, and making remittances cheaper for migrant workers

By Sean Lin / Staff reporter

The Executive Yuan yesterday greenlighted draft amendments to the Act Governing Electronic Payment Institutions (電子支付機構管理條例) that would ease digital money transfers and allow people to save foreign currency to a mobile payment device or app, which would help foreign workers wire money home at a lower cost.

Central to the proposed amendments is the establishment of a financial information exchange and settlement platform so that the mobile payment devices could be integrated with electronic payment services, Banking Bureau Director-General Sherri Chuang (莊琇媛) told a news conference in Taipei, adding that all smartcard companies and payment service providers would join.

The platform would remove barriers between smart payment devices, electronic payment services and banks, allowing people to transfer money between the three, she said.

People cannot use a smart card, such as an EasyCard, to transfer money to a bank account or a payment service, such as Alipay, but they could if the draft amendments are passed, she said.

People would be able to save foreign currencies on their smart cards or payment apps, she said.

People used to shopping online could exchange foreign currencies when the exchange rate is favorable, save them on their devices or apps and get a better price later when they want to make a purchase, she said.

Saving transfer costs for foreign workers is a key component. Bank transfers usually cost between NT$400 and NT$500 for each time, which many migrant workers could not afford, she said.

Two services dedicated to helping migrant workers transfer money abroad for less are being tested in the Financial Supervisory Commission (FSC) regulatory sandbox, she said.

If lawmakers approve the amendments, they would provide a legal basis for foreign workers to repatriate small amounts of money at a reduced cost, although how much the actual processing fees would be requires further discussion, she said.

The platform would also allow people to manage all of their gift vouchers from an app, helping them to save vouchers from different franchises so that they would not have to worry about bringing the wrong vouchers, she said.

The proposals would spare convenience stores the hassle of having to sign individual contracts with payment service providers and they would only need one integrated sensor at the counter, FSC Chairman Thomas Huang (黃天牧) said.

Huang said that he believes the incentives offered by the proposals would motivate more people to embrace electronic payments.

The government has missed its targeted 52 percent penetration rate for electronic payment methods, although that was partially due to the COVID-19 pandemic, he said.

The commission would communicate with legislative caucuses in an effort to get the amendments passed in the next legislative session, he added.

新聞來源:TAIPEI TIMES