《TAIPEI TIMES》 Ex-SinoPac head indicted over loans

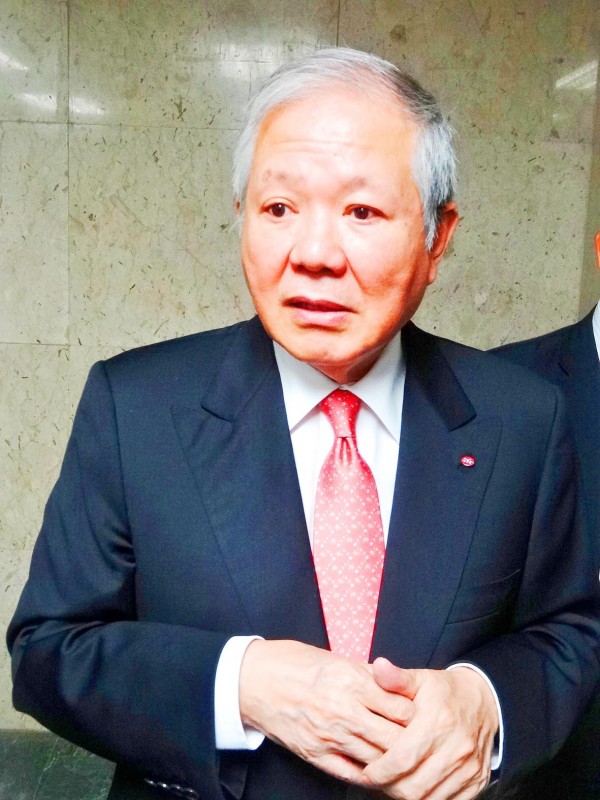

Former SinoPac Financial Holdings Co chairman Ho Shou-chuan, who has been indicted for contravening the Securities Exchange Act and the Banking Act, is pictured in an undated photograph. Photo: Wang Meng-lun, Taipei Times

NO COLLATERAL: Ho Shou-chuan allegedly extended loans to a company run by a relative of his wife through a complex network of business ties. He was released on bail last night

By Jake Chung / Staff writer, with CNA

The Taipei City District Prosecutors’ Office yesterday indicted former SinoPac Financial Holdings Co (永豐金控) chairman Ho Shou-chuan (何壽川) and 18 others for contravening the Securities Exchange Act (證券交易法) and the Banking Act (銀行法).

Ho allegedly extended loans to Sun Power Development and Construction Co (三寶建設), run by a relative of his wife, Chang Hsing-ju (張杏如), without sufficient collateral, violating the limitations on transactions between interested parties as stated under the act, prosecutors said.

Prosecutors are asking for a 12-year sentence for Ho, as well as a fine of NT$360 million (US$11.88 million) and the confiscation of the US$12 million in alleged illegal profits.

Ho, who had been detained since the middle of June along with three other suspects on grounds they might collude with each other on their testimony or destroy vital evidence, was ordered released on bail last night by Judge Chou Yu-chi (周玉綺), even though prosecutors had applied to have all four’s detention periods extended.

At 10pm, Chou ruled that the four could be released and set Ho’s bail at NT$400 million.

Bail for Liao Yi-yin (廖怡慇) — the wife of Sun Power manager Lee Chun-chieh (李俊傑), who is out of the country — was set at NT$50 million, Chen Chia-hsing (陳佳興) — an assistant to SinoPac Leasing Corp (永豐金租賃) chairman Yu Kuo-chih (游國治) — was given bail of NT$10 million and YFY Inc (永豐餘控股) Land Development Division manager Chang Chin-pang’s (張金榜) bail was set at NT$1 million.

All four were able to meet their bail terms and released, but the judge also been barred from leaving Taiwan or relocating from their listed place of residence.

Earlier in the day, in announcing the indictments, prosecutors said Lee invested in Link Mart in 2006 with Ting Hsin Group’s Wei Ying-chiao (魏應交) and Merrill Lynch through Star City Co.

In December 2010, Merrill Lynch backed out of the deal and put its shares, worth US$160 million, up for sale, prosecutors said, adding that Lee intended to buy Merrill Lynch’s shares and reached an agreement with Ho to split the cost.

Ho was to provide US$80 million and instructed Yu and Chen to arrange the funds.

SinoPac Leasing Corp “loaned” Giant Crystal Universal Development, a subsidiary of Sun Power and the parent company of Star City, US$60 million through SinoPac Leasing’s offshore subsidiary, Grand Capital International and Bank SinoPac’s offshore subsidiary SPC Co, the prosecutors said.

The loans were given without any collateral, and the funds were directly transferred under Star City, making SinoPac Leasing Corp an investor rather than a creditor, the prosecutors said, adding that Lee had also became the chairman of the company, which put SinoPac Leasing Corp’s investments at risk.

Ho allegedly instructed US$8.5 million be shifted from YFY and E from Ink (元太科技) and told the companies to write the money off under a different name on their books, while providing the last US$3 million from the Epoch Foundation (新時代基金會), they said.

In return, Ho demanded 20 percent of the loans, or US$12 million, for Ho’s investment in Link Mart.

Prosecutors has indicted Ho for breach of trust, receiving illegal benefits from trading partners under the Financial Holding Company Act (金融控股公司法) and falsifying financial statements.

Yu and Chen were indicted on breach of trust as stated under the Financial Holding Company Act, the Securities Exchange Act and the Criminal Code, prosecutors said.

Lee is wanted for not returning to Taiwan in compliance with an ongoing investigation, they said.

Prosecutors asked for 10-year sentences for Yu and Chen, and fines of NT$30 million and NT$25 million respectively.

新聞來源:TAIPEI TIMES