《TAIPEI TIMES》 Soft landing possible for housing

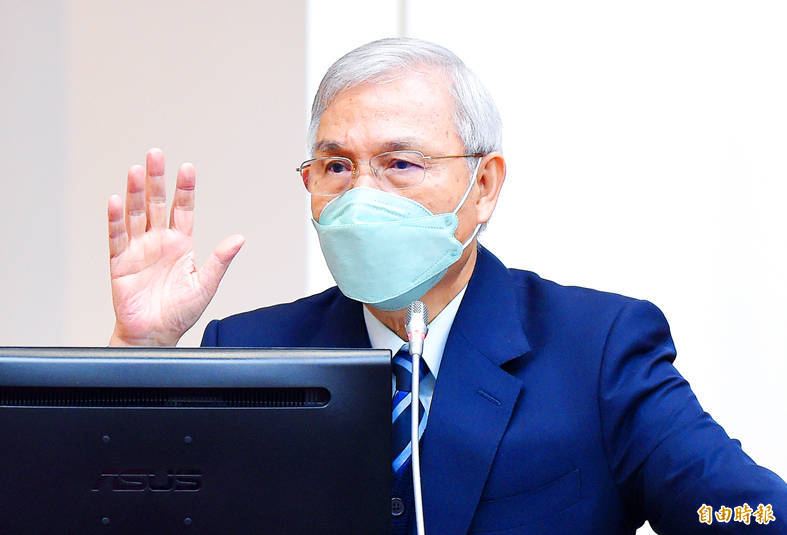

Central bank Governor Yang Chin-long attends a meeting of the legislature’s Finance Committee in Taipei yesterday. Photo: Liao Chen-hui, Taipei Times

By Crystal Hsu / Staff reporter

The local housing market might experience a soft landing in the first half of next year, after months of declining transactions caused by unfavorable policy measures and economic changes, central bank Governor Yang Chin-long (楊金龍) said yesterday.

Yang made the remarks while responding to lawmakers’ questions about the property market, monetary policy and inflation at a meeting of the legislature’s Finance Committee.

“The property market might need more time to assimilate the previous three rate hikes, which were intended to tame inflation but help cool property transactions,” Yang said.

A drop in transactions usually precedes price corrections, he said.

Unaffordable housing is the public’s biggest complaint, especially among young people, surveys have shown.

The number of housing transfers in the nation’s six special municipalities shrunk by double-digit percentage points in the second half of this year, with the pace of retreat accelerating each month, government statistics showed.

Yang has favored a moderate approach to tackling inflation and housing price hikes, while other central bank board directors have pushed for more drastic monetary tightening.

The governor refused to comment on whether interest rates would be raised again on Thursday, saying that all central bank board members are required to say nothing 10 days ahead of a board meeting.

Inflation and the economic outlook would dominate policy discussions, Yang said, adding that consumer price increases of within 2 percent would be acceptable in his opinion.

Research organizations have said that Taiwan’s inflation rate is expected be below target for next year, thanks to tax cuts on imported raw materials and the absence of supply chain disruptions that have plagued the US and Europe.

The central bank must also weigh how seriously the worsening global economic slowdown would affect Taiwan’s GDP growth, Yang said.

Taiwan’s GDP is expected to expand a slight 2.5 percent next year, driven mainly by government and consumer expenditure, as exports slip into contraction this quarter and in the coming six months.

There is no need for Taiwan to copy advanced economies’ monetary policies, and the central bank would deal with the matter based on the nation’s best interests, Yang said.

Analysts generally expect another 0.125 percentage rate hike to narrow Taiwan’s rate gap with the US, as the US Federal Reserve could raise the interest rate by 0.5 percentage points later this week.

Yang said he has reservations about Taiwan Semiconductor Manufacturing Co ( 台積電) founder Morris Chang’s (張忠謀) statement that globalization is dead.

“I don’t agree that globalization is dead, although its content has shifted... That is an extreme statement,” Yang said.

新聞來源:TAIPEI TIMES