《TAIPEI TIMES 焦點》 Global markets hit by ‘Trump slump’ after shock victory

A trader reacts yesterday as he looks at financial data on computer screens on the trading floor at ETX Capital, a broker of contracts-for-difference in London, England. Photo: Bloomberg

/ Reuters, LONDON

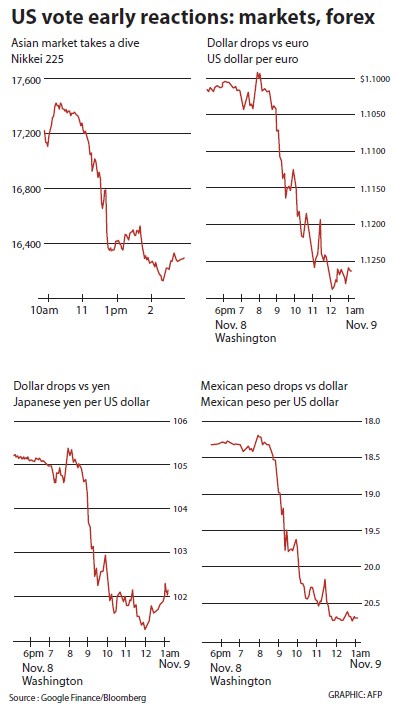

The US dollar, Mexican peso and world stocks fell yesterday as Republican candidate Donald Trump swept to victory in the US presidential election, but fears of a Brexit-style shock that wiped trillions off global markets has failed to materialize so far.

European shares were down less than 1 percent and investors were returning to other markets that had been sent into a tailspin as it became clear that Trump was set for a dramatic victory over heavily favored Democratic candidate Hillary Rodham Clinton.

Investors fear a Trump victory could cause global economic and trade turmoil and years of policy unpredictability, which among other things could discourage the US Federal Reserve from raising interest rates next month.

“I love this country,” Trump said in a victory speech in New York City. “America will no longer settle for anything less than the best... We have a great economic plan, we will double our growth and have the strongest economy in the world.”

Pledges by Trump that he would also forge strong relations with other big nations helped ease concerns of heavy tariffs being slapped on selling to the US and a starkly more aggressive geopolitical stance.

Safe-haven sovereign bonds, the Japanese yen and gold were all giving back ground fast having surged in Asian trading as the election results had come in and, as in the case of the Brexit vote in June, proved polls and betting markets woefully wrong.

As markets in Asia toppled, Sean Callow, a foreign exchange strategist at Sydney-based Westpac, said the reaction had been “as though the four horsemen of the apocalypse just rode out of Trump Tower.”

The mood in early European trade was far more measured.

“The initial reaction in markets was violent,” Saxo Bank head of FX strategy John Hardy said. “But if you look at it across markets you are seeing a pretty decent reversal off the spike.”

The mild 0.7 percent dip in European stocks was nowhere near as bad as the 4 percent plunge futures markets had indicated and the near 9 percent slump they initially suffered after the UK’s Brexit vote.

Mexico’s peso also bounced, roughly 4 percent, off a record low it had hit overnight — although it was still down an eye-watering 8.5 percent as emerging markets bore the brunt of the impact.

Trump’s threats to rip up a free-trade agreement with Mexico and tax money sent home by migrants to pay for building a wall on the southern US border have made the peso particularly reactive to the US election.

As foreign exchange markets reeled in Asia, South Korean authorities were thought to have intervened to steady their currency.

Japan’s top currency diplomat signaled Tokyo’s readiness to intervene if necessary as the surging yen threatened to snuff out its fragile economic recovery.

The risk of a global trade war knocked other currencies across Asia, with the Australian dollar leading the rout.

Asian stocks showed the day’s biggest dents. MSCI’s broadest index of Asia-Pacific stocks outside Japan ended down 2.3 percent and the Nikkei in Tokyo closing down 5.4 percent.

新聞來源:TAIPEI TIMES