《TAIPEI TIMES》Central bank hikes rate for fourth time

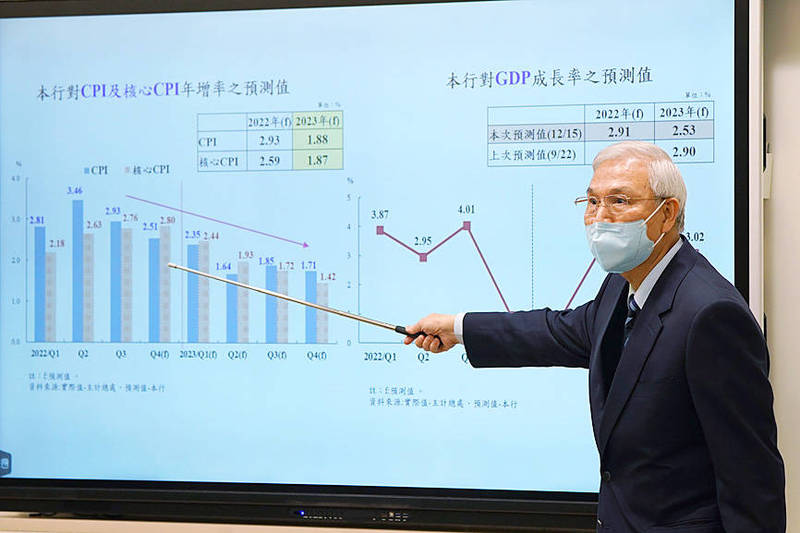

Central bank Governor Yang Chin-long attends a news conference following a quarterly board meeting in Taipei yesterday. Photo: CNA

RISING DEBT: The latest interest adjustment would drive the mortgage rate above 2% for the first time since 2009, adding to homeowners’ burden, Sinyi Realty said

By Crystal Hsu / Staff reporter

The central bank yesterday raised its policy rate by 0.125 percentage points for the fourth time this year to help tame inflation, which remains above its target ceiling of 2 percent, but might ease to an acceptable range next year.

The move, which was widely expected, brought the rediscount rate up to 1.75 percent, effective today.

“There are no complementary measures this time, because the rate hikes alone would suffice,” as a slowing global economy, capital outflows, commodity price hikes and other unfavorable economic twists would already lead to a tightening effect, central bank Governor Yang Chin-long (楊金龍) told a media briefing.

The policy decision did not win unanimous support, with three board members pushing for a 0.25 percentage point hike to cope with stubborn inflation at home and abroad, he said.

The central bank stood by its previous forecast that the consumer price index (CPI) next year would advance 1.88 percent, while core CPI, which strips out volatile items, would increase 1.87 percent.

However, the central bank trimmed its forecast for GDP growth this year to 2.91 percent and 2.53 percent next year.

Asked if the monetary tightening cycle has come to an end amid heightening economic risks, Yang said that economic data, chiefly inflation, would guide its policy decisions.

“I cannot promise a policy turnabout until we are sure that CPI growth would be subdued below the 2 percent mark,” he said.

Consumer prices rose 2.97 percent in the first 11 months of this year, still some distance from the central bank’s comfort zone.

However, the rapid deceleration in exports and GDP growth stopped the central bank from further adjusting banks’ required reserve ratios, the governor said.

While more effective in curbing inflation, required reserve ratios, unlike interest rate changes, cannot send as a clear message to the market about the central bank’s policy stance, Yang said.

The governor, whose tenure is to end early next year, said the central bank helped the nation emerge stronger from the COVID-19 pandemic in terms of economic performance and resilience.

Yang told a legislative hearing earlier this week that he had not received notice of an extension of his term.

The Cabinet is expected to be reshuffled next month following the ruling party’s massive losses in last month’s local elections.

The latest rate hike, though mild, would drive mortgage rates above 2 percent for the first time since 2009, said Sinyi Realty Inc (信義房屋), the nation’s only listed broker.

That would mean paying an additional NT$36,564 (US$1,194) per year for a 30-year mortgage on a NT$10 million property, Sinyi said, adding that it could lead to 18 percent of prospective home buyers shelving purchasing plans.

新聞來源:TAIPEI TIMES